Comparative Analysis of Gold Demand: Physical Gold Bars vs. Gold ETFs

Gold occupies a unique position in the global financial system, functioning simultaneously as a commodity, a monetary asset, and a strategic store of value. Over the past five years, gold demand has been shaped by extraordinary macroeconomic developments, including the COVID-19 pandemic, unprecedented monetary stimulus, inflationary pressures, geopolitical tensions, and a rapid tightening of monetary policy since 2022. Against this backdrop, investor demand has primarily expressed itself through two channels: physical gold bars and gold-backed ETFs. While both serve investment purposes, their demand patterns, drivers, and investor profiles differ materially.

Background: Physical Gold Bars and Gold ETFs

Physical gold bars represent direct ownership of bullion, typically held in private or institutional vaults. Demand for bars is commonly associated with long-term wealth preservation, protection against systemic risk, and distrust in financial intermediaries. Buyers include private investors, family offices, and high-net-worth individuals seeking tangible, unencumbered assets.

Gold ETFs, by contrast, are financial instruments that track the price of gold and are usually backed by allocated bullion held by a custodian. They offer liquidity, ease of access, and seamless integration into portfolio management systems. ETFs appeal primarily to institutional investors, hedge funds, and tactical allocators who use gold as a short- to medium-term positioning tool.

Demand Trends Over the Last Five Years

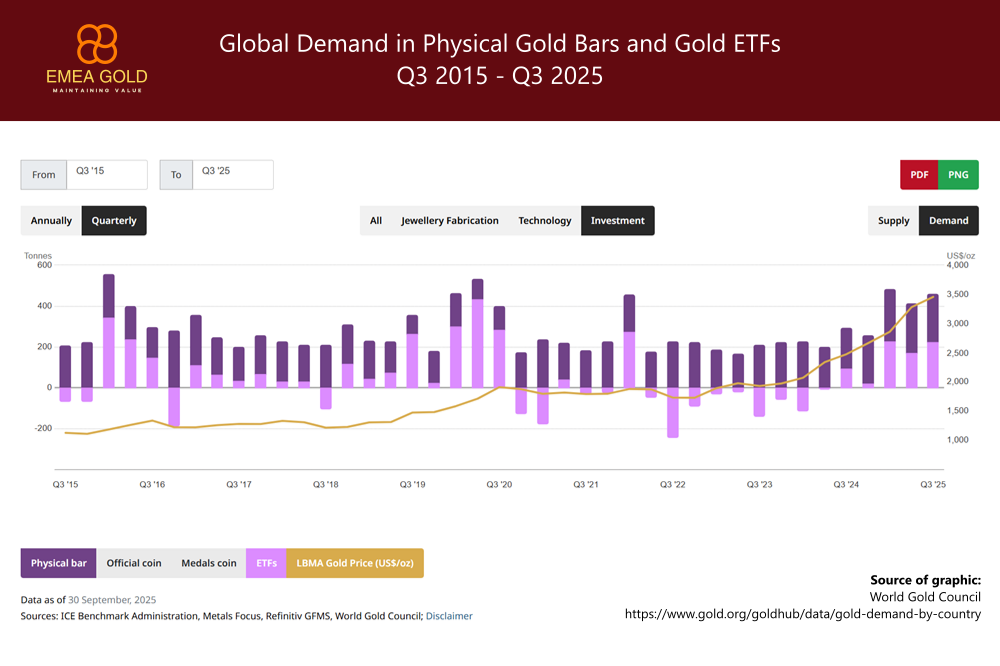

The chart illustrates pronounced divergences between physical bar demand and ETF flows across the last five years. Physical gold bar demand has remained consistently positive, with relatively moderate volatility across quarters. Even during periods of declining gold prices or rising interest rates, bar demand shows resilience, underscoring its role as a strategic, long-term allocation rather than a trading instrument.

ETF demand, by contrast, exhibits high cyclicality. During periods of crisis and monetary expansion - most notably in 2020 and early 2022 - ETF inflows surged sharply as investors sought rapid exposure to gold amid market uncertainty and negative real yields. However, these inflows proved reversible. As central banks began tightening monetary policy and real yields turned positive in 2022 and 2023, ETF holdings experienced significant outflows, occasionally turning deeply negative on a quarterly basis.

Comparative Evaluation of Physical Gold Bars and Gold ETFs

The contrasting demand profiles highlight fundamental differences in investor motivation:

- Stability vs. Sensitivity

Physical gold bar demand is structurally stable, driven by capital preservation motives and low sensitivity to short-term price movements. ETF demand is highly sensitive to interest rates, opportunity costs, and macro expectations. - Strategic vs. Tactical Allocation

Bar investors typically acquire gold as a long-term hedge against inflation, currency debasement, and geopolitical risk. ETF investors are more tactical, often increasing or reducing exposure in response to monetary policy shifts or price momentum. - Ownership and Counterparty Considerations

Physical bars offer direct ownership without reliance on financial intermediaries, which becomes particularly attractive during periods of systemic stress. ETFs, while operationally efficient, introduce counterparty, custodial, and regulatory considerations that can influence investor confidence during market disruptions.

Recent Developments and Implications

In the most recent quarters shown in the chart, rising gold prices have coincided with a renewed recovery in ETF demand, suggesting a return of momentum-driven and institutional interest. Importantly, this recovery builds on an already solid base of physical bar demand, indicating a broad-based investor endorsement of gold rather than a narrow speculative phase.

This dual strength is notable. Historically, periods in which both physical demand and ETF inflows rise simultaneously tend to coincide with sustained bullish phases in the gold market. Physical demand provides a durable foundation, while ETF inflows amplify price movements through financial market participation.

Conclusion

The last five years clearly demonstrate that physical gold bars and gold ETFs play complementary but distinct roles in gold investment demand. Physical bars serve as a cornerstone asset for long-term security and wealth preservation, exhibiting remarkable consistency across economic cycles. Gold ETFs function as a flexible, liquid vehicle for tactical positioning, amplifying gold’s responsiveness to macroeconomic change.

For investors, understanding these differences is critical. A balanced gold strategy may incorporate both instruments - physical gold for structural resilience and ETFs for liquidity and portfolio agility - depending on investment horizon, risk tolerance, and strategic objectives.

Whether your priority is stability, diversification, or yield generation anchored in the gold sector, our services are built to support a disciplined, high-integrity investment strategy.