Physical Gold vs. Gold ETFs:

What Is the Difference and Which Is Better for Investors?

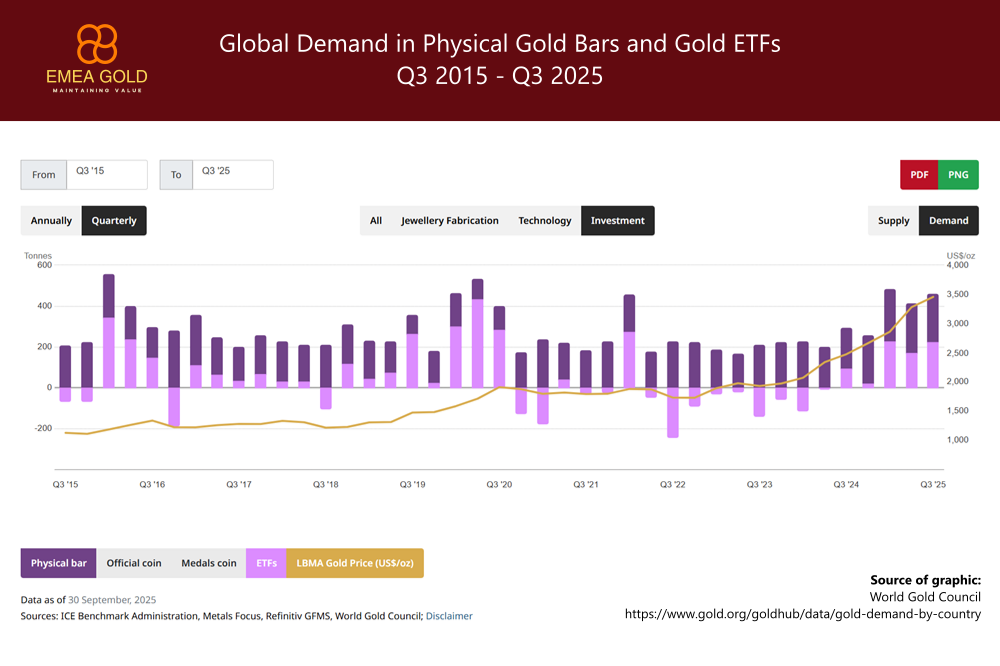

Gold remains one of the most enduring assets in global finance. It offers stability, protection against systemic risks, and the ability to preserve wealth across generations. Today, investors most commonly gain exposure to gold in two ways: buying physical gold or investing in gold ETFs. While both track the value of the same underlying asset, each approach carries distinct advantages, risks, and structural characteristics.

For investors evaluating the best way to incorporate gold into a long-term strategy—particularly those interested in secure physical ownership, professional storage, or gold-related investment opportunities—understanding these differences is essential.

What Is Physical Gold?

Physical gold refers to gold bars, coins, and investment-grade bullion that an investor directly owns. Ownership is absolute and not dependent on any financial institution.

At EMEA GOLD, physical bullion is sourced exclusively from verified, licensed suppliers and stored in secure, institutional-grade vaults, providing investors with documented authenticity, audited inventory control, and full legal title.

Key characteristics of physical gold:

- You own the metal directly.

- It is independent of the banking and financial system.

- It serves as a long-term, crisis-resilient store of value.

What Are Gold ETFs?

Gold ETFs (Exchange-Traded Funds) are financial securities listed on stock exchanges. They aim to track the price of gold, either through physical holdings or by using financial derivatives such as futures.

Investors own shares in a fund, not the gold itself. ETFs offer convenience and liquidity, but exposure is indirect and tied to the stability of custodians, brokers, and fund structures.

Key characteristics of Gold ETFs:

- Quick and liquid access to price movements

- No physical possession

- Subject to management fees and market infrastructure risks

Advantages of Investing in Physical Gold

1. Direct Ownership Without Counterparty Risk

Physical gold is one of the few assets with no counterparty risk. It does not rely on banks, brokers, custodians, or fund managers. During economic stress or geopolitical instability, this independence provides unmatched security.

2. Tangibility and Long-Term Preservation

Gold has preserved purchasing power for centuries. Unlike fiat currencies or financial instruments, physical gold cannot be devalued by monetary policy, corporate restructuring, or market failures.

3. Strategic Privacy and Control

In many jurisdictions, physical gold allows greater privacy than financial securities. Investors maintain control over where and how their gold is stored.

At EMEA GOLD, clients may choose professionally vaulted storage, ensuring both discretion and top-tier security.

4. Ideal for Intergenerational Wealth

Physical bullion is well suited for family wealth strategies, long-term reserves, and asset protection structures.

Disadvantages of Physical Gold

1. Storage and Insurance Costs

Owning bullion requires secure storage and insurance. Professional vaulting services—like those provided by EMEA GOLD—are designed to minimise these risks but do come with associated annual fees.

2. Lower Liquidity vs. ETFs

While physical gold is liquid globally, converting bars or coins to cash is not instantaneous and often involves spreads that are wider than ETF bid-ask ranges. However, sophisticated vaulting services that both sell and store gold are generally providing buy-back services with same-day procedures. EMEA GOLD does offer such services through associates and partners in several jurisdictions.

3. Importance of Trusted Supply Chains

Authenticity, purity verification, and legal sourcing are critical. Working with established providers is essential to ensure compliance with global standards.

Advantages of Investing in Gold ETFs

1. High Liquidity and Ease of Trading

ETFs offer immediate buy/sell execution during market hours. Investors can adjust positions instantly, which makes ETFs attractive for tactical or short-term strategies.

2. Lower Entry Costs

ETFs allow small investment sizes with minimal transaction fees—suitable for retail investors or those seeking partial exposure.

3. No Storage Requirements

The ETF structure eliminates the need for vaulting, insurance, or logistics. This makes ETFs operationally simple.

4. Seamless Portfolio Integration

ETFs integrate well into brokerage accounts, managed portfolios, and retirement platforms.

Disadvantages of Gold ETFs

1. Indirect Exposure and Counterparty Risk

ETF investors do not own gold. They own a claim on a fund, which is subject to custodial risk, regulatory oversight, and the stability of financial intermediaries. In systemic stress events, this distinction can be significant.

2. Erosion Through Management Fees

Expense ratios reduce returns annually. Over time, investors may underperform the gold price by several percentage points.

3. No Tangibility, No Redemption

ETF shares cannot be redeemed for bullion in practical terms. Investors seeking physical control or emergency-access assets will not achieve this through ETFs.

Which Is Better: Physical Gold or Gold ETFs?

The answer depends on your investment goals:

Choose Physical Gold If You Prioritise:

- Wealth preservation and long-term stability

- Assets outside the financial system

- Protection against systemic or geopolitical risk

- Strategic reserve holdings or intergenerational planning

- Secure, discreet, professionally vaulted storage

These objectives align directly with EMEA GOLD’s core services: physical gold acquisition, global vaulting solutions, gold trade finance, and gold mining investment opportunities.

Choose Gold ETFs If You Prioritise:

- Short-term exposure

- High liquidity and fast trading

- Lower entry costs

- Integration into conventional financial portfolios

A Combined Approach for Sophisticated Investors

Many professional investors choose a hybrid model, allocating:

- A core position in physical gold for long-term preservation, plus

- A tactical position in ETFs for liquidity and rebalancing flexibility.

This approach balances strategic security with operational efficiency.

How EMEA GOLD Supports Your Gold Strategy

At EMEA GOLD, we offer a full suite of solutions for investors seeking to build or expand a position in physical gold or access gold-related investment returns:

- Secure acquisition of physical gold sourced directly from verified suppliers

- Professional vaulting and insured storage in high-security facilities

- Buy-back and liquidity solutions

- Participation in gold trade finance transactions with attractive risk-adjusted returns

- Investment opportunities in licensed, professionally managed gold mining projects

Whether your priority is stability, diversification, or yield generation anchored in the gold sector, our services are built to support a disciplined, high-integrity investment strategy.